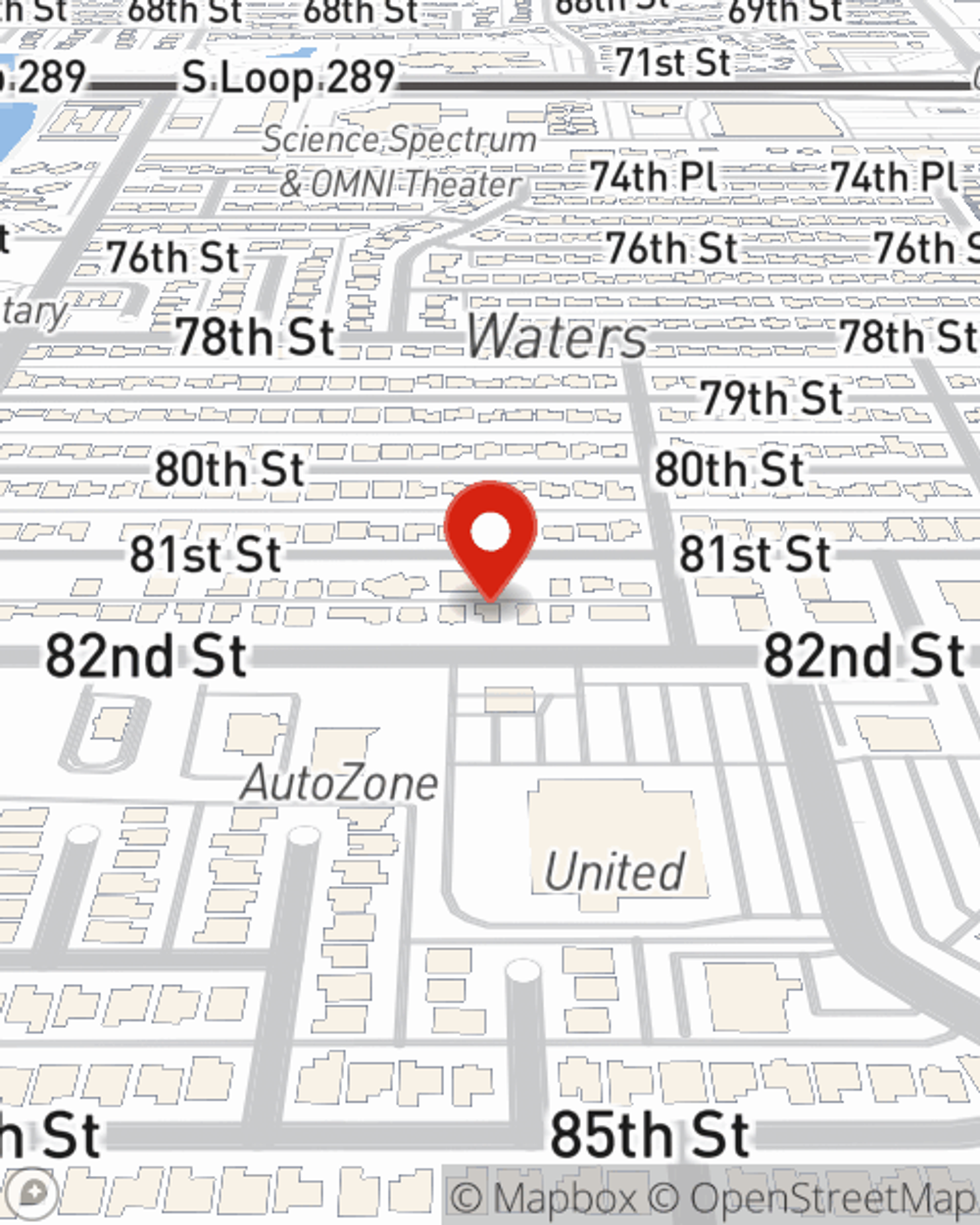

Homeowners Insurance in and around Lubbock

If walls could talk, Lubbock, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Lubbock

- Lubbock county

- Texas

- Amarillo

- Andrews

- Midland

- Odessa

- shallowater

- Idalou

- Brownfield

- Levelland

- Plainview

- Floydada

- Tulia

Home Sweet Home Starts With State Farm

Committing to homeownership is an exciting time. You need to consider home layout neighborhood and more. But once you find the perfect place to call home, you also need excellent insurance. Finding the right coverage can help your Lubbock home be a sweet place to be.

If walls could talk, Lubbock, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

Protect Your Home With Insurance From State Farm

State Farm's homeowners insurance secures your home and your belongings. Agent Samuel Robertson is here to help set you up with a plan with your specific needs in mind.

Great homeowners insurance is not hard to come by at State Farm. Before the accidental occurs, contact agent Samuel Robertson's office to help you figure out what works for your home insurance needs.

Have More Questions About Homeowners Insurance?

Call Samuel at (806) 792-2244 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Sauna benefits, types and safety tips

Sauna benefits, types and safety tips

A good steam bath is invigorating. Learn the benefits of saunas and the best way to use them with these simple but important safety tips.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Samuel Robertson

State Farm® Insurance AgentSimple Insights®

Sauna benefits, types and safety tips

Sauna benefits, types and safety tips

A good steam bath is invigorating. Learn the benefits of saunas and the best way to use them with these simple but important safety tips.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.